UK Car VED Rate Changes for 2017

The way Vehicle Excise Duty (VED) is calculated is changing for some vehicles registered from 1 April 2017. All vehicles registered before this date will not be affected.

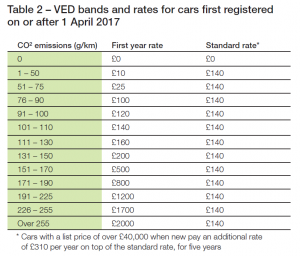

The changes, announced by the Chancellor in the 2015 budget, set out that from next year, the first vehicle licence will be calculated on the vehicle’s CO2 emissions.

The majority of vehicles will then move to a standard rate of £140 annually from the second licence.

Cars with zero emissions will not pay the standard rate of vehicle tax. However, if a car’s list price is over £40,000 at first registration, the customer will pay the additional rate for five years after the end of the first licence.

How it will work

- Tax rates for vehicles registered before 1st April 2017 will not be affected by this change.

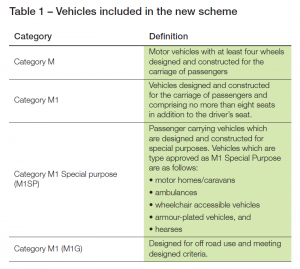

- Only M1, M1SP and M1G type approved vehicles are impacted by these changes (for definitions of vehicles included in these changes see table 1 below).

- The way in which tax is calculated for all other vehicle types will not be changing.

- All vehicles (M1, M1SP and M1G) with zero emissions will be exempt from the standard rate of vehicle tax. All other vehicles will pay a standard rate of £140 a year.

- An additional rate will be added to the vehicle tax for all new vehicles with a list price of over £40,000. This additional rate of £310 will be payable each year for 5 years from the end of the first vehicle licence. After the 5 year period the standard rate will apply.

- Zero emission vehicles will have a standard rate of £0 but if the list price is over £40,000 they will pay the additional rate of £310 a year for 5 years.

- Multi stage build M1SP and M1G vehicles without a CO2 emissions figure shown as part of the final type approval will continue to be taxed as PLG. Where there is a CO2 figure they will be taxed under the new scheme.

What this will mean for the customer

- If a customer buys a brand new vehicle registered on or after 1st April 2017, after the first licence the majority of vehicles move to the standard rate of vehicle tax which is £140 a year.

- If the vehicle list price was over £40,000 at first registration, the customer will pay £450 a year, after the first vehicle licence. This is made up of the £140 standard rate and £310 additional rate. After five years the vehicle tax will revert to the standard rate of £140 per year.

- Vehicles with a list price exceeding £40,000 with zero emissions (including electric) will pay the additional rate of £310 a year for a 5 year period, after the first licence. After the 5 year period these vehicles will pay zero vehicle tax.

- Alternative fuel vehicles will continue to receive a £10 reduction on vehicle tax rates

What this will mean for dealers

- New first licence rates will be introduced from 1 April 2017. (See table 2 below)

- These rates will be based on the CO2 emissions of the vehicle.

- The list price of vehicles subject to the scheme must be provided when the vehicle is first registered.

- This list price will be provided by the manufacturer or dealer/retailer and reflect the vehicle list price on the day before it is first registered and taxed.

- For new M1, M1SP and M1G imported/Kit built vehicles, the list price or notional price is provided by the person/importer registering the vehicle.

- Notional price will be used where the list is price is not known.

- A full definition of list price and notional price will be issued

(This page was viewed 72 times today and shared 1 times)