Is PCP Halal And How Does It Work?

Personal Contract Purchase (PCP) is a popular financing option for buying cars in the UK. It can be a good choice for those who want affordable monthly payments and flexibility at the end of the contract, but it’s important to understand how it works before committing and deciding is PCP halal.

For most Muslims this will not be an option as it involves interest on the loan but if you feel it is something you wish to look into here’s a breakdown:

The Basics:

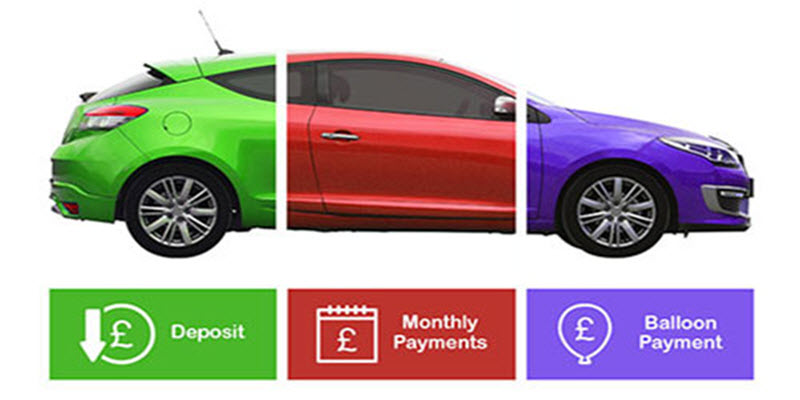

- Deposit: You’ll typically put down a deposit upfront, which reduces the amount you finance and lowers your monthly payments. Most PCP deals have a maximum starting deposit of 30-50%

- Monthly payments: These payments cover the depreciation of the car over the course of the agreement, not the full cost. This is why they’re typically lower than other financing options.

- Guaranteed Minimum Future Value (GMFV): This is an estimate of the car’s worth at the end of the contract term. It’s pre-agreed upon and affects the size of your final payment.

- Final payment: At the end of the contract, you have three options:

1/ Pay the GMFV and own the car: You can usually pay this in one go or refinance it again. You would only keep the car it its value was higher than the GMFV.

2/ Hand the car back: You simply return the car with no further obligation. You would only do this if the car had devalued below the GMFV amount.

3/ Part-exchange for a new car: The most common option. You can use the car’s value as a deposit on a new PCP deal. You would do this if the cars value was more than the GMFV otherwise the hand-back option would be better.

Things to Consider:

- Interest rates: PCP deals typically have higher interest rates than traditional loans, so the total cost of the car could be higher in the long run.

- Mileage restrictions: PCP agreements often have mileage limits. Exceeding these limits can come with penalty fees. NOTE: This is more of a concern only if you hand the car back.

- Ownership: You don’t own the car until you pay the final payment.

- Balloon payment: The final payment can be a significant amount, and you need to plan how you’ll cover it if you decide to keep the car.

Overall, PCP can be a good option for:

- Those who want lower monthly payments. You can still pay the whole amount off at any point or make partial payments at any point without any additional fees or costs.

- People who like to change cars regularly, usually every 2-3 years. You are not committed to keeping the car for the full term and can look at changing at any point subject to figures of course.

- Drivers who stick to low mileage. A low annual mileage will usually offer a better payment on a PCP deal.

However, it’s not for everyone. It’s important to carefully consider the costs and risks before taking out a PCP deal. It’s also worth comparing PCP with other financing options, such as Personal Contract Hire (PCH), Hire Purchase (HP) and traditional car loans to find the best option for your needs.

PCP is also based on age of the car you are buying. Most lenders will only offer PCP finance on cars up to a certain age and/or mileage.