Is Car Leasing Halal And How Does It Work?

The term Car Leasing has been generally used to describe various forms of car finance options but it actually refers to Contract Hire. There are two main types of Contract Hire which are Personal Contract Hire (PCH) and Business Contract Hire (BCH). As opposed to purchasing a car with a view to keeping it these are more like a long-term rental agreements.

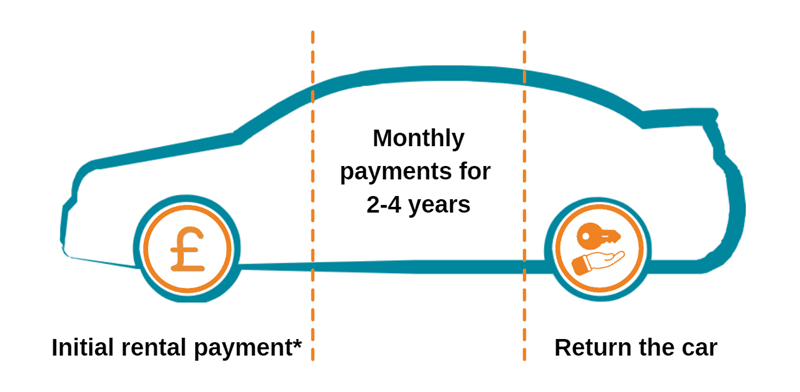

The good news is most Contract Hire agreements don’t show any interest rates or APR’s so this is a great option for many trying to avoid paying interest. Here’s how it works:

How it works:

- Choose your car and set the terms: Pick your desired car from a dealership or online. You’ll decide on the contract length (usually 2-4 years) and how many miles you expect to drive (annual mileage allowance).

- Initial payment: Unlike traditional buying, you’ll typically pay an initial deposit, often in the range of 1-6 months’ worth of your monthly payments.

- Monthly payments: Throughout the contract, you’ll make fixed monthly payments to the finance company covering the car’s depreciation (loss of value) during the contract period. These payments are usually lower than a traditional car loan because you’re not paying off the full cost of the car.

- End of the contract: When the contract ends, you simply return the car to the finance company in good condition with normal wear and tear. There’s no obligation to buy it although some companies may give you the option.

Key things to remember:

- You don’t own the car: You’re essentially renting it for the duration of the contract.

- Mileage limits: Going over your agreed mileage allowance can incur extra charges.

- Condition at return: Excessive wear and tear beyond normal use could also result in fees.

- No purchase option: Unlike Hire Purchase (HP) or Personal Contract Purchase (PCP), you cannot usually choose to buy the car at the end of the PCH agreement.

- Renewal or change: At the end of the contract, you can either return the car and lease a new one, or potentially arrange a separate purchase deal if still interested in the car.

Advantages of PCH:

- Lower monthly payments: Generally cheaper than traditional car loans due to not covering the full car value.

- New car every few years: Drive a new car every few years with the latest technology and features.

- Predictable costs: Fixed monthly payments for budgeting ease.

- Maintenance Options: You may add this option onto the agreement to cover things like servicing and tyres

- No resale worries: Avoid the hassle of selling a used car.

Disadvantages of PCH:

- No ownership: You never own the car, essentially paying rent for its use.

- Mileage limits: Exceeding the agreed mileage can be expensive.

- Early termination fees: Leaving the contract early might incur hefty charges so coming out early could get expensive.

Overall, PCH is a good option if you:

- Want to drive a new car every few years without ownership commitment.

- Prefer predictable monthly payments with no interest charges.

- Don’t plan on doing high mileage.

- Are comfortable with not owning the car and returning it at the end.

If you’re considering PCH, it’s crucial to:

- Compare quotes from different lenders to find the best deal.

- Read the contract carefully and understand all the terms and conditions.

- Be realistic about your driving habits and choose an appropriate mileage allowance.

- Factor in potential additional costs like excess mileage charges.

(This page was viewed 122 times today and shared 1 times)